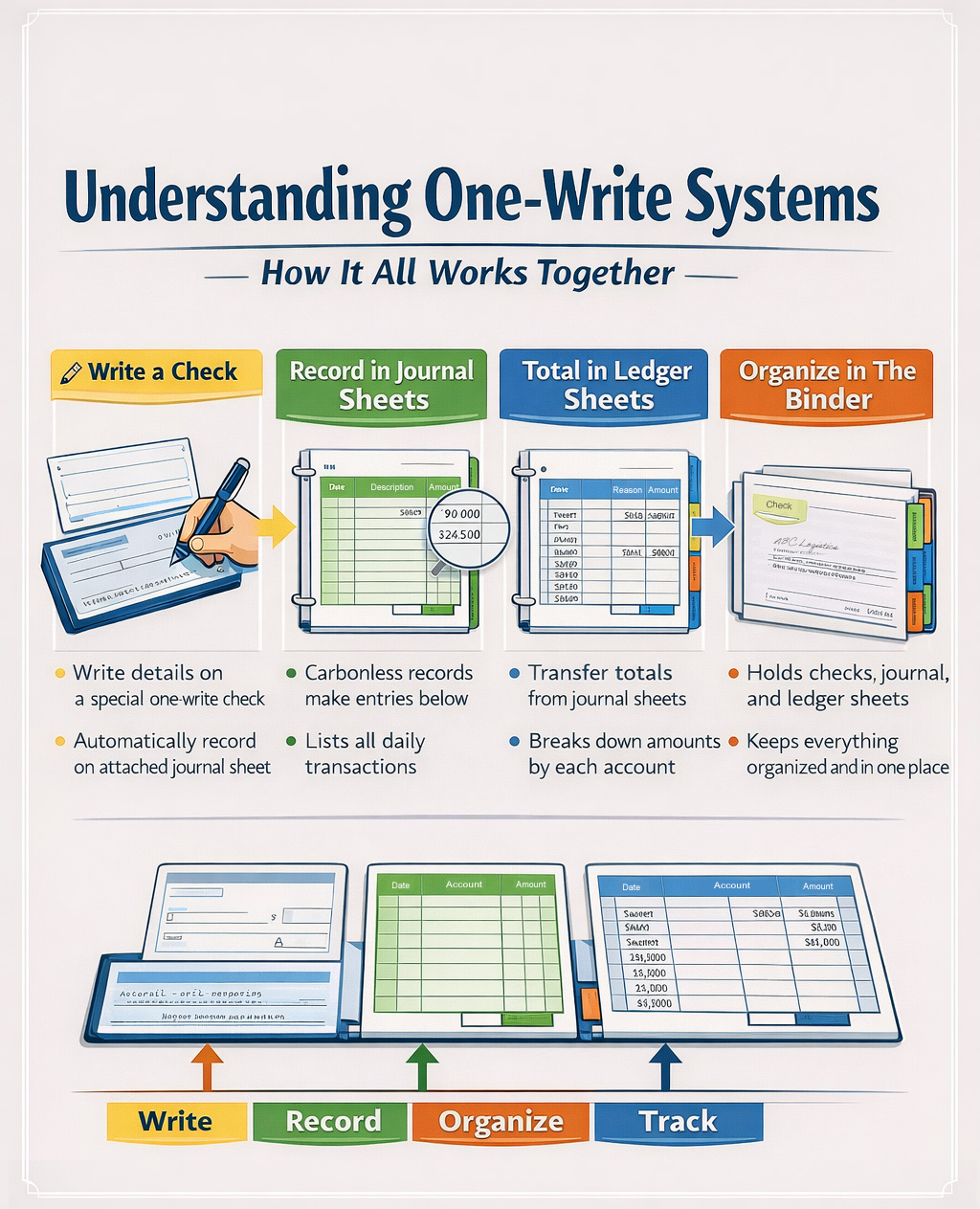

A manual accounting system can feel confusing because it involves several tools that work together to record, organize, and review financial activity. This post breaks down one-write checks, journals, ledgers, and boards, and explains how they connect in a practical, easy-to-follow way.

One-Write Checks: The Starting Point

One-write checks are designed to simplify recordkeeping by capturing multiple accounting records from a single action.

When you write a one-write check, the pressure from the pen transfers the information onto several layers beneath the check. These layers typically include:

- The check itself (given to the payee)

- A check register or journal copy

- Sometimes an additional internal record for tracking or auditing

Why One-Write Checks Matter

- You only write the information once

- The transaction is recorded automatically

- Reduces errors from rewriting the same data multiple times

In short, one-write checks are the trigger that starts the accounting trail.

Journals: Recording Transactions in Time Order

A journal is the first formal accounting record where transactions are logged in chronological order.

Every time a one-write check is written:

- The transaction is entered into the journal

- Key details are recorded: date, payee, amount, and accounts affected

Think of the journal as a daily diary of financial activity.

Common Types of Journals

- Cash Disbursements Journal – payments made by check

- Cash Receipts Journal – money received

- General Journal – adjustments and non-routine entries

The journal answers the question: “What happened, and when?”

Ledgers: Organizing by Account

While journals record transactions by date, ledgers organize transactions by account.

A ledger is a collection of individual accounts, such as:

- Cash

- Accounts Payable

- Office Supplies

- Rent Expense

Each journal entry is later posted to the appropriate ledger accounts.

Why Ledgers Are Important

- Show balances for each account

- Make it easy to see totals and trends

- Provide the data needed for financial statements

If the journal is a diary, the ledger is a filing cabinet, grouping related information together.

Boards: The Binder That Holds It All Together

In this system, the board is a physical or organizational binder that brings the accounting records together in one place.

Think of the board as a structured binder that can hold:

- Journals

- Ledgers

- Check copies or one-write check records

Each section of the binder is clearly organized, allowing information to be added, reviewed, and referenced without disrupting the rest of the system.

Why the Board-as-Binder Matters

- Keeps all records centralized

- Maintains a clear, consistent order of documents

- Makes audits, reviews, and lookups faster and more reliable

Rather than recording transactions itself, the board provides the framework that supports and protects the records inside it.

Just like a binder with labeled tabs, the board ensures that journals stay with journals, ledgers stay with ledgers, and nothing gets lost as records accumulate over time.

How It All Works Together

Here’s the full flow from start to finish:

- One-write check is written – transaction begins

- Journal entry is created – transaction is recorded in time order

- Ledger posting occurs – amounts are categorized by account

Each step builds on the previous one, creating a clear and reliable accounting trail.

Conclusion

One-write checks, journals, ledgers, and boards each serve a distinct purpose, but they are most powerful when used together. The system ensures:

- Accuracy through single-entry capture

- Organization through structured records

- Accountability through oversight

Understanding how these parts connect makes accounting less intimidating and highlights why proper recordkeeping is essential for any organization.

If a manual accounting solution is right for you, please view the one-write products that Smart Resolution has to offer and get started right away!